GHS2.4bn gov’t debt enough to pay our clients – GN

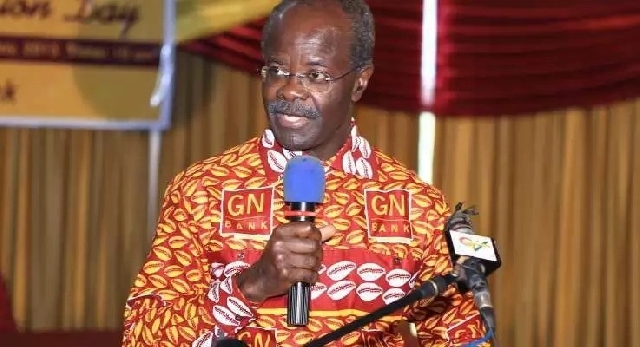

Dr Papa Kwesi Nduom

Dr Papa Kwesi Nduom

Dr Papa Kwesi Nduom’s Group Nduom (GN), the parent company of Gold Coast Fund Management (GCFM), now rebranded Blackshield Fund Management, has blamed the government for its inability to meet its financial obligations to its customers.

Blackshield was part of the 53 fund management firms whose licences were revoked by the Securities and Exchange Commission (SEC) a few weeks ago.

The conglomerate’s GN Bank had been earlier downgraded to GN Savings and Loans, and was further collapsed after some savings and loans firms had their licences withdrawn.

The group says the government should pay its contractors who are owed GHS2.4 billion – a claim the government disputes – so that the firm can retrieve the monies and pay its clients.

“The rule of law respects the sanctity of contracts, so, contractors must be paid. That money will go straight to customers. The GHS2.4 billion does not belong to Dr Papa Kwesi Nduom or Groupe Nduom,” a statement from GNs Corporate Affairs unit noted.

The release also cautioned against politicising the development, cautioning that: “This is not and cannot be an NPP/NDC matter”.

Below is the full statement:

The value of the Gold Coast Government Infrastructure Portfolio if paid today, will be enough to pay back all the Gold Coast/BlackShield/GCFM Structured Finance principal amounts PLUS all GN Bank/Savings deposits.

So, let’s focus on the solution and who must act.

This is not and cannot be an NPP/NDC matter. This is beyond politics.

The rule of law respects the sanctity of contracts. So, contractors must be paid. That money will go straight to customers. The GHS2.4 billion does not belong to Dr Papa Kwesi Nduom or Groupe Nduom.

That is why we are in court. To ensure that the liability is recognized to be what it is. And paid to meet the demands of customers. When this happens, the customers, Groupe Nduom and Government will all have peace of mind.

What is owed by private sector companies when recovered will provide a return on BlackShield/GCFM customers’ investments.

These are the facts.

Signed

GN Corporate Affairs

Source: ClassFMOnline.com

Trending Business

Non-performing energy sector heads to be sacked -Energy Minister warns

13:14

Insurance brokers do not face trust issues with insurers – Shalbu Ali

12:11

IBAG reflects on a “mixed year” as industry records major wins

11:46

Domestic tourism spending hits GH₵6.59bn in 2023 - GSS

08:55

Bank of Ghana holds post-MPC engagement with bank CEOs after 127th meeting

03:53

Ghana's Cybele Energy makes history with offshore Guyana oil block deal

12:53

IBAG elects new executives at 12th general meeting

04:57

First Atlantic Bank PLC set for official listing on the Ghana Stock Exchange

12:46

SIC Managing Director James Agvenim-Boateng honoured by IBAG

05:34

IMF technical mission engages Ghana on implementing governance reforms

05:08