High operational costs impede electronic payment drive – BoG

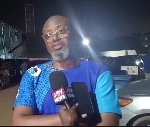

Dr Ernest Addison

Dr Ernest Addison

The Bank of Ghana says the deployment of Point of Sales terminals has not been universally adopted to drive electronic payments due to high set up and operational costs.

This comes despite the number of mobile money transactions increasing seven-fold from about GHS266 million in 2015 to over GHS2 billion in 2019.

Against this background, the focus of the Bank of Ghana is to expand 3 merchant payment options with a view to providing market solutions that are “infrastructure-light” but transformational and speed up electronic payment acceptance.

Speaking at the launch of Ghana’s first universal QR code payment solution, the Governor of the Bank of Ghana, Dr Ernest Addison, said the launch comes at a better time as it encourages the use of alternative forms of payment in the light of the Covid-19 pandemic.

“We still have more to do to ensure that more individuals are paying for goods and services on a daily basis using digital means.

“Therefore, launching of a Unified QR code today, which is expected to bring a simplified user experience for customers to make payments to any merchant and for small merchants particularly, to receive payment from anyone”, he explained.

The QR code is a more cost-effective alternative to traditional POS terminals.

It is easy to use and versatile and provides a solution to the fragmented e-payment landscape as it is compatible to the available e-payment products such as ATM machines, credit and debit cards, online banking and mobile banking.

In addition, it minimises termination of e-payments in cash.

The introduction of the QR Code is an integral part of the Payment Systems Strategic Plan (2019–2024) captured under the Financial Technologies Strategy Pillar. Therefore, today’s event demonstrates Bank of Ghana’s commitment to the realisation of this essential pillar of the Payment Systems Strategy.

Source: classfmonline.com

Trending Business

Employment up 330,000 by Q3 2025, unemployment averages 12.8% – GSS

06:57

GOLDBOD Jewellery unveils festive Christmas and New Year collections

18:17

Importers and Exporters Association kick against planned introduction of AI system at Ghana's ports

11:47

TDC unveils vision for Oxygen City development in Ho

09:59

First Atlantic Bank PLC marks major milestone with oversubscribed IPO and upcoming GSE listing

08:51

IMF unlocks US$380 million disbursement for Ghana under ECF

00:42

GIPC boss outlines government’s key economic priorities for 2026

15:40

GIPC call stronger investment partnership with Suriname

15:32

Non-performing energy sector heads to be sacked -Energy Minister warns

13:14

Insurance brokers do not face trust issues with insurers – Shalbu Ali

12:11