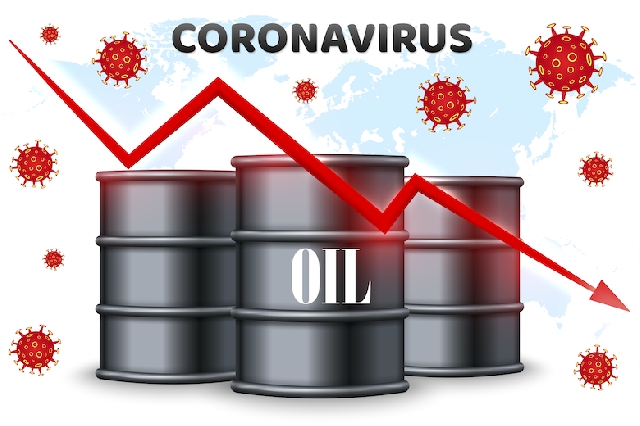

Oil falls 3% as COVID-19 infections raise demand concerns

oil decline

oil decline

Oil fell 3% on Monday, extending last week’s losses as growing cases of COVID-19 in the United States and Europe raised worries about crude demand, while the prospect of increased supply also hurt sentiment.

Brent crude LCOc1 was down $1.25 cents, or 3%, at $40.52 by 0755 GMT. U.S. West Texas Intermediate (WTI) dropped $1.28 cents, or 3.2%, to $38.57, having fallen more than a dollar shortly after the start of trading.

Brent fell 2.7% last week and WTI dropped 2.5%.

The United States reported its highest number yet of new coronavirus infections in two days through Saturday, while in France new cases hit a record of more than 50,000 on Sunday, underlining the severity of the outbreak.

On the supply side, Libya’s National Oil Corp on Friday ended its force majeure on exports from two key ports and said production would reach 1 million barrels per day (bpd) in four weeks, a quicker ramp-up than many analysts had predicted.

“New barrels of Libyan oil come at a time when the crude oil market had just faced the disappointment from the recently concluded OPEC+ ministerial panel when the organisation made no new policy proposals,” said Avtar Sandu, senior manager commodities at Phillip Futures in Singapore.

OPEC+, a grouping of producers including the Organization of the Petroleum Exporting Countries (OPEC) and Russia, is also set to increase output by 2 million bpd in January 2021 after cutting production by a record amount earlier this year.

Russian President Vladimir Putin indicated last week he may agree to extending OPEC+ oil production reductions.

In the United States, energy companies increased their rig count by five to take the total to 287 in the week to Oct. 23, the most since May, energy services firm Baker Hughes Co BKR.N said. The rig count is an indicator of future supply.

Still, investors increased their net long positions in U.S. crude futures and options during the week through Oct. 20, the U.S. Commodity Futures Trading Commision said on Friday.

Source: Reuters

Trending Business

GIPC champions bold reforms to attract small and impact investors into Ghana’s SME sector

11:43

'Adwumawura' Grant Committee begins selection of 2,000 youth businesses in Ho

08:39

SIC Insurance PLC honoured at Ghana Re Cedants Awards

08:26

Samantha Cohen CVO OBE Leads Landmark Ghana Visit

13:23

GRA dismisses fears over new VAT regime, says reform will reduce prices and ease business costs

06:35

Pwalugu Tomato Factory reopening: Mahama supplies farmers with high-yield seeds, targets job creation and reduced post-harvest losses

03:07

PPPs key to meeting Ghana’s infrastructure goals in 2026 - EM Advisory

14:31

Cedi stability faces test as external risks mount in 2026 - EM Advisory

14:23

C/R: Chiefs back government’s palm nut drive to boost jobs and development

17:25

Maiden AGROTECH Fair 2026 to showcase Ghana’s agricultural technology and drive agro-industrial growth

13:25