BoG to sanction financial institutions flouting anti-money laundering, anti-terrorism regulations

Governor of the Bank of Ghana (BoG), Dr Ernest Addison

Governor of the Bank of Ghana (BoG), Dr Ernest Addison

Financial institutions that go contrary to the anti-money laundering and anti-terrorism requirements of the Bank of Ghana (BoG) would be sactioned, the central bank has warned.

The BoG and the Financial Intelligence Centre, are mandated to ensure that accountable institutions regulated by Bank of Ghana comply with Anti-Money Laundering, Combating the Financing of Terrorism and Proliferations of Weapons of Mass Destruction (AML/CFT&P) requirements.

Accountable institutions are required to conduct their business with high ethical standards and avoid undertaking business relationships that may facilitate ML/TF&PF.

The Anti-Money Laundering Act, 2020 (Act 1044), Anti-Terrorism Act, 2008 (Act 762), Anti-Terrorism (Amendment Act), 2012 (Act 842), Anti-Terrorism (Amendment Act), 2014 (Act 875), Anti-Money Laundering Regulations, 2011 (L.I.1987) which intensified Ghana’s efforts towards the fight against money laundering, terrorism and proliferation financing (ML/TF&PF), have provisions for both judicial and administrative sanctions applicable to non-compliant institutions.

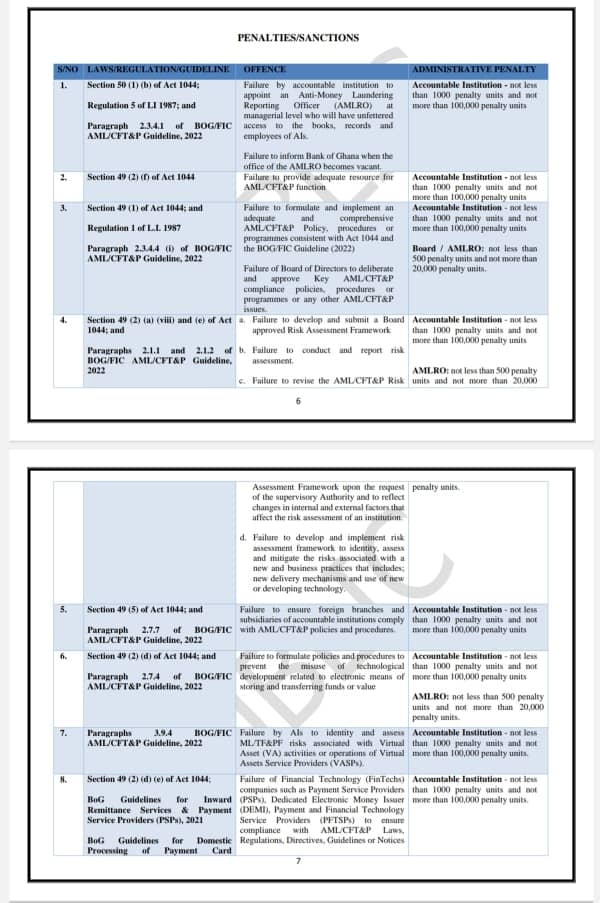

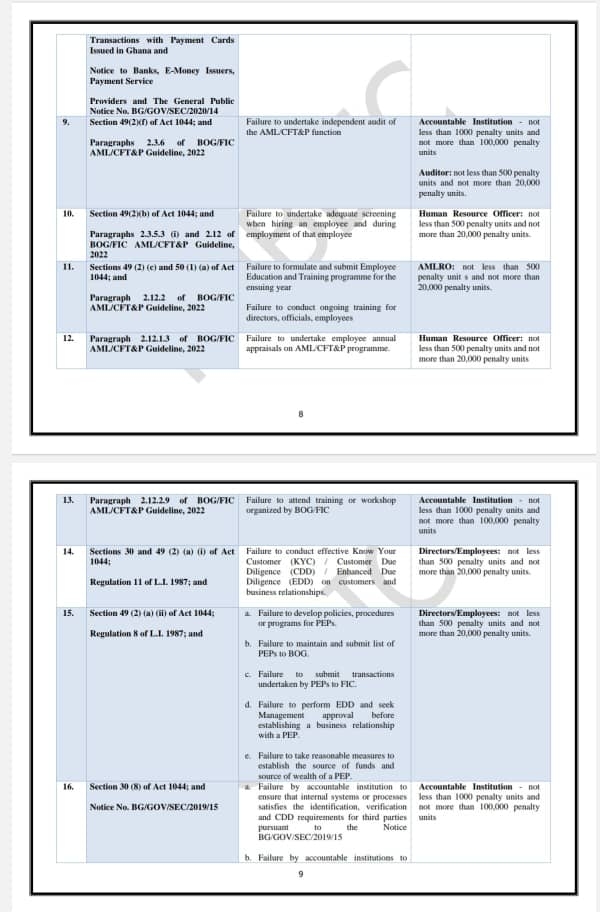

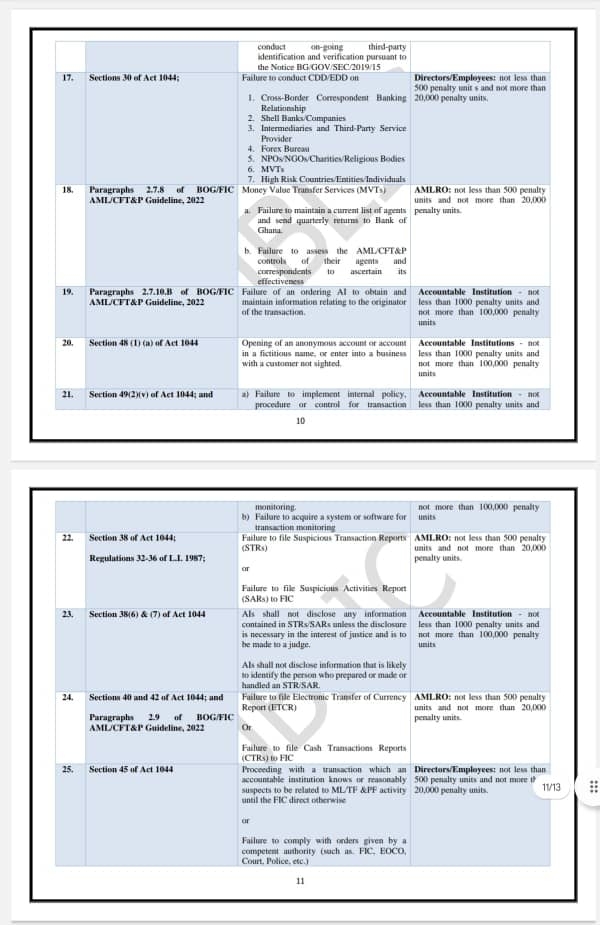

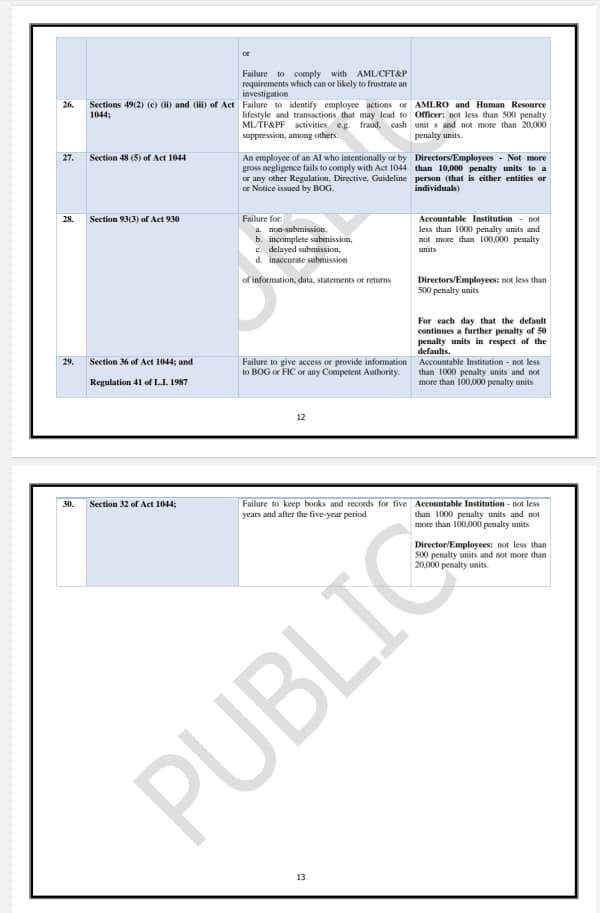

Revising the previous document on sanctions and giving clarity to the administrative sanctions regime of the Bank of Ghana in view of the passage of Anti-Money Laundering Act, 2020 (Act 1044), the central bank outlined the following:

ADMINISTRATIVE SANCTIONS IMPOSED BY BANK OF GHANA AND FINANCIAL INTELLIGENCE CENTRE

The Bank of Ghana, for the purposes of the supervision and enforcement of AML/CFT&P shall impose one or more of the following sanctions in accordance with section 53 of Act 1044:

1. A written warning to an individual of an accountable or an accountable institution;

2. In the case of an individual, an administrative penalty of not less than five hundred (500) units

and not more than twenty thousand (20,000) penalty units;

3. In the case of an entity, an administrative penalty of not less than one thousand (1000) penalty units and not more than one hundred thousand (100,000) penalty units;

4. A letter disqualifying a person from managing an accountable institution;

5. BoG may publish the name of any accountable institution or an individual of an accountable

institution that persistently breach any of the AML/CFT&P requirements;

6. A suspension of the license of an accountable institution; and

7. A revocation of the license of an accountable institution.

Source: classfmonline.com

Trending Business

TAGG raises alarm over GRA–TRUEDARE digital customs deal

14:15

Government, Afreximbank resolve issues over US$750m facility

10:17

Muntaka Entrepreneurship Hub trains over 100 women in Asawase

14:16

Ghana Gold Board rakes in over $10bn ahead of target

09:56

GEXIM faces GHS1.5bn credit exposure as NPLs near 30% — CEO

09:36

Six Degrees delivers immersive experiential production at Kweku Smoke’s revival concert

10:37

GIPC highlights govt’s commitment to retail sector transformation at GUTA conference

03:01

Lower-Volta Small-Scale Miners & Farmers to host international livestock market

00:43