Ghana first country in the world to implement bank-wide mobile money service – Bawumia

Dr Mahamudu Bawumia

Dr Mahamudu Bawumia

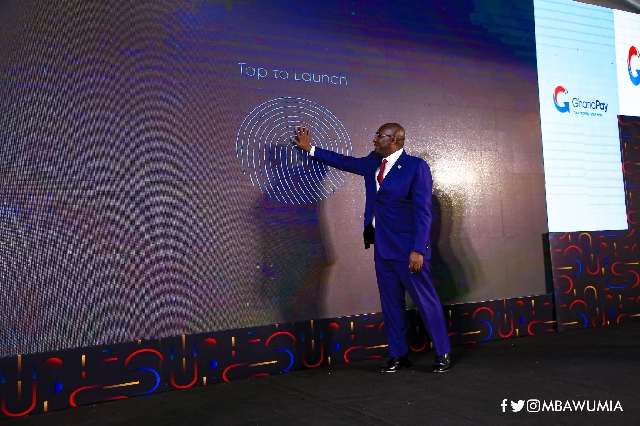

Vice-President Mahamudu Bawumia on Wednesday, 15 June 2022, launched the GhanaPay mobile money service, the first bank-wide mobile money service by universal banks, rural banks, as well as savings and loans companies to individuals and businesses.

The service, which operates like the existing mobile money service, also has additional banking services, and is opened to everyone with access to a mobile phone, with or without a traditional bank account.

Dr Bawumia described it as another groundbreaking initiative, “which further expands our government's vision for financial inclusion, especially to the unbanked population through digital banking.”

He disclosed that Ghana becomes the first country in the world that has implemented a bank-wide mobile money service.

To this end, he congratulated the Central Bank, the Ghana Association of Bankers, GhIPSS and all other stakeholders for the collaborative effort to make this possible.

For his part. Bank of Ghana Governor Ernest Addison said the launch of the GhanaPay mobile wallet, “marks yet another milestone in the digitisation of the financial system”.

Speaking at the launch, Dr Addison said: “Banks in Ghana are re-inventing themselves and have continued to respond positively to the competitive nature of the payment systems, characterised by increased consumer preferences for convenience and frictionless payment options”.

“This collaborative effort of a common electronic wallet would enable economies of scale through pooling of resources. By establishing this common GhanaPay mobile wallet, the cost of testing any new technology for each bank is reduced and allows new ways of doing business. Indeed, this is an exciting development for Ghana’s payment systems landscape and demonstrates how collaboration with the banking sector can proffer solutions for the transformation and deepening of the payments ecosystem”.

Trending Business

Government, Afreximbank resolve issues over US$750m facility

10:17

Muntaka Entrepreneurship Hub trains over 100 women in Asawase

14:16

Ghana Gold Board rakes in over $10bn ahead of target

09:56

GEXIM faces GHS1.5bn credit exposure as NPLs near 30% — CEO

09:36

Six Degrees delivers immersive experiential production at Kweku Smoke’s revival concert

10:37

GIPC highlights govt’s commitment to retail sector transformation at GUTA conference

03:01

Lower-Volta Small-Scale Miners & Farmers to host international livestock market

00:43

Nigeria's commercial dispute involving Ghanaian firm raises bilateral trade concerns-UK Certified Customer Communication expert warns

21:31