'I'm unequivocal Agyapa the way to go'; fix concerns, push it through – Ofori-Atta to MIIF board

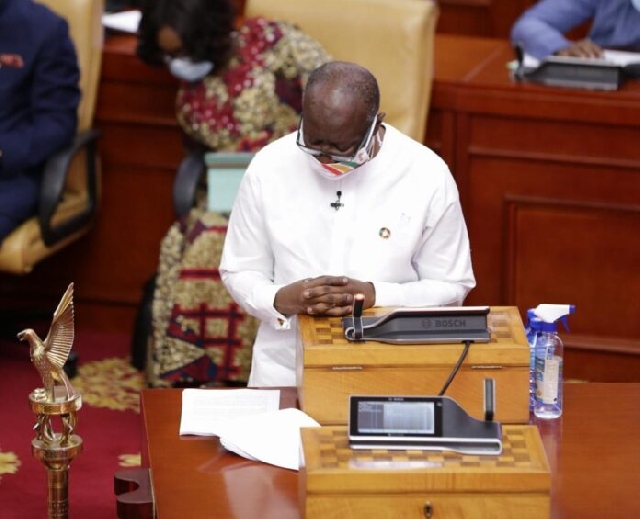

Finance Minister Ken Ofori-Atta

Finance Minister Ken Ofori-Atta

Finance Minister Ken Ofori-Atta has said the Agyapa royalties deal is the way to go as far as monetising Ghana’s mineral resources.

He has, thus, charged the Board of the Minerals Incomes and Investment Funds (MIIF) to address all the concerns raised against the deal before it is re-submitted to parliament for approval.

At the inauguration of the nine-member board of the Mineral Income Investment Fund in Accra on Tuesday, 12 October 2021, Mr Ofori-Atta said: “You must continue with the work that has been done following the theme of the budget ‘Continuity, Consolidation and Completion’ and address and overcome all the concerns against the Agyapa transaction, so we can go to the market and create the first mineral royalty company in Ghana and in Africa because it is good for Ghana.”

“The Attorney General has looked at it”, he noted.

“We had a few stakeholder meetings, and I think the new board should be energised to review that and go through the parliamentary process. I’m unequivocal that it is the way to go in terms of monetising our minerals and finding a way to leverage mining,” he added.

In December 2020, Transparency International urged the UK Financial Conduct Authority (FCA) to make detailed inquiries into the government of Ghana’s application to list Agyapa Royalties Limited on the London Stock Exchange and to reject the listing if corruption concerns were not satisfactorily addressed.

The banks and lawyers involved in the deal were also urged to withdraw their engagement.

Agyapa Royalties Limited is a Jersey-based special purpose vehicle that would own almost 76 per cent of the royalties generated from 16 large gold mines in Ghana under a scheme that has caused controversy and political fallout in Ghana.

Forty-nine per cent of shares in Agyapa Royalties are to be sold through a listing on the London Stock Exchange.

Following the controversies over the Agyapa deal, the Special Prosecutor at the time, Mr Martin Amidu, raised red flags over the risk of money laundering in the deal and possible bid-rigging in the contracting of advisors.

Mr Amidu shared his report publicly in November, which gave further impetus to the advocacy for a review of the Agyapa Royalties deal.

In a submission to the FCA – and forwarded to J.P. Morgan, Bank of America Merrill Lynch International and law firm White and Case – Transparency International detailed concerns shared by a coalition of almost 30 Ghanaian and international civil society organisations that the deal smacks of corruption.

Linda Ofori-Kwafo, Executive Director of Ghana Integrity Initiative, the Ghana chapter of Transparency International, said at the time: “There are serious red flags in how this deal was set up. Concerns have been raised by civil society actors around inadequate stakeholder consultation, transparency and the valuation of the deal. Other concerns bother on the way transaction advisors became involved in the process and a lack of public oversight over the company at the heart of the deal. It is crucial for Ghana that the western financial institutions and regulators involved in this deal take these concerns seriously. They must not facilitate schemes that may end up plundering Ghana’s mineral resources in the name of investment.”

The government later withdrew the deal so it can fix the concerns.

Source: classfmonline.com

Trending Business

TAGG raises alarm over GRA–TRUEDARE digital customs deal

14:15

Government, Afreximbank resolve issues over US$750m facility

10:17

Muntaka Entrepreneurship Hub trains over 100 women in Asawase

14:16

Ghana Gold Board rakes in over $10bn ahead of target

09:56

GEXIM faces GHS1.5bn credit exposure as NPLs near 30% — CEO

09:36

Six Degrees delivers immersive experiential production at Kweku Smoke’s revival concert

10:37

GIPC highlights govt’s commitment to retail sector transformation at GUTA conference

03:01

Lower-Volta Small-Scale Miners & Farmers to host international livestock market

00:43