Inflation projected to hover around 8±2% band

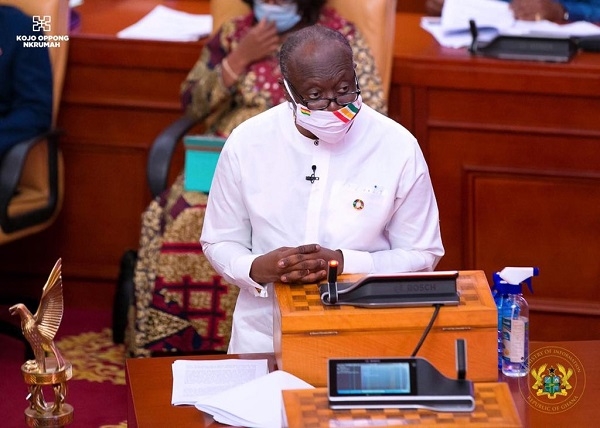

Ken Ofori-Atta

Ken Ofori-Atta

Headline inflation has been trending downwards in 2021, staying closer to the central path target of 8 per cent for the first time since the onset of the COVID-19 pandemic, Finance Minister Ken Ofori-Atta told parliament on Thursday, 29 July 2021, when he presented the mid-year budget review.

Headline inflation declined marginally from 10.4 per cent in December 2020 to 10.3 per cent in March 2021 before falling sharply to 7.5 in May 2021 and then increased marginally to 7.8 per cent in June 2021.

The decline in headline inflation, according to him, was on account of base-drift effects from the waning of pandemic-induced food price shocks and stability on the exchange rate front.

Food inflation eased sharply from 14.1 per cent in December 2020 to 7.3 per cent June 2021.

Non-food inflation, on the other hand, rose from 7.7 per cent in December 2021 to 8.2 per cent in June 2021.

The uptick in non-food inflation in the year could be attributed to the recorded higher inflation for rent and rising ex-pump prices of petroleum products following the recovery in crude oil prices.

In line with the decline in headline inflation, underlying inflation, measured by core inflation also continued to trend downwards.

The bank’s main measure of core inflation, which excludes energy and utilities prices, remained steady at 10.9 per cent in December 2020 before decelerating sharply to 7.5 per cent in June 2021.

However, the measures of inflation expectations firmed up in April as the implementation of tax measures and increase in ex-pump prices affected the price outlook of economic agents in the recent round of the survey, Mr Ofori-Atta noted.

In the outlook, headline inflation is projected to remain within the medium-term target band of 8±2 per cent, supported by easing food price pressures, base-drift effects, relative stability of the exchange rate, and well-anchored inflation expectations, he said.

He noted that the Bank of Ghana will continue to pursue prudent policies to safeguard this favourable low inflation environment.

In the medium-term (2022-2025), inflation is expected to edge downward to an average of 7.8 per cent, supported by relatively stable exchange rate and slower money supply growth, he added.

Source: Classfmonline.com

Trending Business

Vice President pushes for balanced partnerships in an engagement with IMF officials

09:04

GIPC hosts major business forum with Japanese delegation to boost investment ties

15:24

GFZA hosts Japanese business delegation to boost investment and Ghana–Japan trade ties

14:12

Ghana Gold Board signs refining agreement with Gold Coast Refinery

12:52

First Atlantic Bank secures approval to operate in liberia

12:07

Ghana–Pennsylvania talks open new pathways for agricultural investment and market expansion

11:00

Goldbod Jewellery and CavemanWatches explore partnership for global standard gold watch production

11:31

Regularise your practice: CIMG calls on marketing practitioners to comply with the law

19:00

NEIP governing board meets as Youth Minister pushes business acceleration agenda

18:09

HOTWAVE pays courtesy visit to Ga Mantse

06:47