Bank bust: BoG chases shareholders, directors, loan defaulters

“I am also reliably informed that the Receivers have fully engaged the judicial system to assist in the recovery of certain assets and monies from some of the shareholders, directors and other loan defaulters of these erstwhile institutions, with about 50 cases currently pending before the courts,” Dr Addison said in a speech at the 4th Ghana CEOs Summit in Accra on Monday, 20 May 2019.

Dr Addison expressed frustration about the processes in recovering assets, such as individuals “resorting to the court system to frustrate the process by engaging in frivolous actions”.

He cited “low or poor documentation” as another factor which presents a challenge for the Receivers to identify and pursue some of the loan defaulters.

Dr Addison revealed that preliminary investigations have indicated that “some of the assets were not registered in the names of the specific financial institutions but in the names of related or connected parties, making it difficult to dispose of the underlying collateral to offset the outstanding loans”.

He was concerned that “some of these loans were even fictitiously created” and, so, the authorities are making every effort to pursue the directors and retrieve the monies.

A clean-up of the banking sector resulted in the revocation of the licences of nine local banks.

Seven banks went bust within a space of one year – from August 2017 to August 2018. They include UT Bank, Capital Bank, uniBank, Sovereign Bank, The Royal Bank, The Beige Bank and The Construction Bank. The first two went under in August 2017.

The other five went bust two weeks shy of a year after the first two failed.

Two other banks – Heritage Bank and Premium Bank – had their licences withdrawn after the deadline for the payment of the GHS400m minimum capital requirement in December 2018.

UT Bank and Capital Bank were taken over by GCB Bank while the last seven were put together by the BoG to form the all-new CBG.

In his updates after the clean-up, Dr Addison noted that: “Out of the total loans of GHS10.1 billion taken over by the Receivers, total recoveries so far is in excess of GHS731 million and this has been achieved through loan repayments by customers; repayment of placements; sale of vehicles; liquidation of bonds; and from other incomes sources (largely from interests on placements and refund of commissions paid)”.

He said loan repayments by customers alone constitute about 72 per cent of the total proceeds realised.

Source: Ghana/ClassFMonline.com/91.3FM

Source: David Apinga

Trending News

Nana Kwame Bediako disputes UK court judgment over alleged $14.9m debt

16:40

For the sake of the soul and spirit of NPP, vote Bryan Acheampong -Yeboah to delegates

17:32

African Trade Chamber appoints Bahamian Senator Barry Griffin to board

00:57

NAiMOS officer shot, armed assailant killed during anti-galamsey operation in Bono Region

07:53

A-Plus urges Ghanaians to keep NPP in opposition to “learn governance”

11:47

MoH orders investigation into Fourth Estate report on Ridge Hospital

14:32

PRESEC condemns labelling school as breeding ground for homosexuals

11:57

COCOBOD CEO must account for costs after case dismissal -Edem Senanu

16:42

IGP Special Operations Team arrests military officers for possession of substances suspected to be Indian hemp in Tamale

17:19

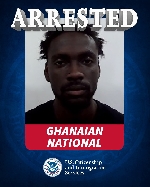

US authorities arrest individual described as “Ghanaian alien” over criminal history

00:15