S&P rates Ghana’s upcoming $3bn Eurobond 'B/Stable'

The rating agency holds the view that Ghana currently has the capacity to meet its financial obligation but faces major ongoing uncertainties that could impact its financial commitment on the obligation.

“S&P Global Ratings said today that it has assigned its 'B' long- and short-term foreign and local currency issue ratings to the proposed senior unsecured global medium-term note programme to be issued by Ghana (B/Stable/B),” the agency noted in a statement on its website. On Friday, 15 March 2018.

It added that the amount and interest rate, along with other details pertaining to the issuance of the Eurobond, will be determined during their placement.

The government intends to use proceeds from the notes as a stopgap measure for the weakening Ghana Cedi, which strengthened by 0.2 per cent within the week to 5.6452 per the US Dollar, the first weekly gain since 15 February 2019.

S&P had earlier maintained its 'B/B' long- and short-term foreign and local sovereign credit ratings for Ghana following pressure on public finances, with interest payments representing over 30% of government revenues.

S&P also assigned a stable outlook due to what it describes as fairly strong growth prospects.

Source: Ghana/ClassFMonline.com/91.3FM

Source: David Apinga

Trending News

Three GCTU scholars named among world’s top 2% scientists

09:43

Ghana cannot secure digital platform monetisation amid cybercrime, Minister warns

11:29

Vice President charges UENR graduates to pursue purpose-driven innovation

09:24

ECOWAS Council of Ministers endorse John Mahama as sole candidate for AU chair in 2027

10:33

Let's strengthen safe, inclusive school environments – Apaak urges

11:10

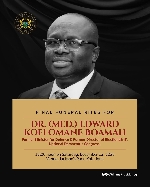

Final funeral rites for late Defence Minister Dr. Edward Omane Boamah this weekend in Koforidua

11:07

No 13th-month salary for teachers-MoE clarifies

10:37

Police interdict five officers over unauthorised use of uniforms on social media

12:46

68th Ordinary ECOWAS Summit: President Mahama arrives in Abuja, Nigeria

18:59

Ghana, Colombia reinforce alliance on reparative justice and South-South cooperation

10:27