GRA unveils new initiatives to boost tax revenue

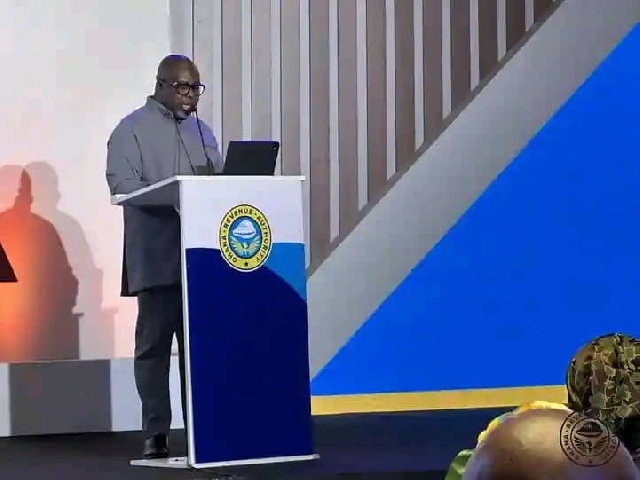

Mr Anthony Sarpong

Mr Anthony Sarpong

The Ghana Revenue Authority (GRA) has launched a sustained tax education programme and a modified taxation scheme aimed at increasing tax revenue and expanding the tax net.

The initiative seeks to rake in more than 2 million taxpayers in the first year of implementation, with the potential to add over GHS10 billion to domestic tax revenue annually.

According to Acting Commissioner-General of the GRA, Mr Anthony Sarpong, the programme is designed to simplify tax payment and increase tax awareness across the country.

He believes that this will boost the tax-to-Gross Domestic Product ratio in the next three years.

The GRA's analysis suggests that the informal sector, which comprises about 8 million businesses and individuals, has significant potential for tax revenue growth.

The authority aims to bring on board 2 million taxpayers in the first three years, with the potential to increase domestic revenue in subsequent years.

Deputy Minister for Finance, Thomas Nyarko Ampem, hinted that the 2026 Budget, to be presented on November 13, 2025, will include tax reliefs for citizens through the restructuring of Value Added Tax (VAT).

Chief of Staff, Julius Debrah, commended the GRA for the initiative, urged the Authority to pay attention to night businesses in light of the 24-hour economy.

The campaign is themed "Promoting Voluntary Compliance through Sustained Tax Education," reflecting the GRA's commitment to educating taxpayers and promoting compliance.

Source: Classfmonline.com/Edem Afanou

Trending Business

BoG sets June 2026 deadline for DCS providers to regularise operations

11:54

Rainbow Agro Science Supports 41st National Farmers’ Day Celebration

10:54

Energy Minister reaffirms gov't’s commitment to revitalising Ghana’s upstream petroleum sector

09:17

SSNIT begins quarterly payments to NPRA after resolution of longstanding financial dispute —Nyarko Ampem confirms

15:24

BoG to hold 127th Monetary Policy Committee meetings in November

13:38

Soya Value Chain Association urges gov't to lift soybean export ban

10:37

Energy Minister highlights link between energy, water, and food at global solar forum

10:22

World College of Mayors signs landmark partnership with Ghana’s shea industry stakeholders

03:33

DVLA launches SMS notifications for license renewal and replacement

18:00

MPs tour Akuse rice farms to observe methane emissions

14:38