'Ghana in economic crisis but not broke' – Adei

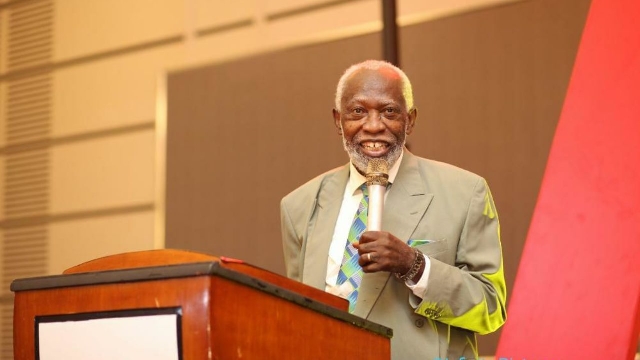

Prof Stephen Adei

Prof Stephen Adei

Ghana is in a short-term economic crisis but the country is not broke, former Rector of the Ghana Institute of Management and Public Administration (GIMPA), Prof Stephen Adei, has said.

In an interview with Class91.3FM’s morning show on Wednesday, 17 February 2022, Prof Adei told Kofi Oppong Asamoah that despite the current challenges the economy is going through, Ghana cannot be said to be a basket case.

“I think that Ghana, we have a good country with a good future but we have a short-term challenge; it is quite obvious. We know that at the end of last year, the fiscal deficit was 12.1 per cent, inflation has started climbing up to 12.6 per cent; the currency, which was quite stable – in fact, two years ago, we were the best-performing currency in Africa; I think – is now depreciating very fast; I think the latest, even the official one is about 6.8 per cent [at the bureau]; petrol prices have almost doubled, recently there was a Fitch downgrading of the rating of Ghana to B-“, he observed.

Prof Adei, however, said: “It is a short-term economic crisis”, adding: “Nobody should deny that one. It is a fact”.

He warned: “If we don’t manage it well, it can lead us into trouble but I don’t think that we can say that the country is broke”.

In his view, “It is a matter of economic crisis which has to be managed”.

“Let me quote former Senior Minister Yaw Osafo Marfo; when he was a Minister of Finance, one day he said, ‘Na who cause am?’”

A few weeks ago, Investors Service (Moody’s) downgraded Ghana’s long-term issuer and senior unsecured debt ratings to Caa1 from B3 and changed the outlook to stable from negative.

Moody’s said on Friday, 4 February 2022: “The downgrade to Caa1 reflects the increasingly difficult task the government faces addressing its intertwined liquidity and debt challenges”.

“Weak revenue generation constrains government’s budget flexibility, and tight funding conditions on international markets have forced the government to rely on costly debt with shorter maturity”, Moody’s noted.

Moody’s said its projection shows that more than half of the country’s revenue will go into the payment of interests for the next few years, and proposals by the government to fix the challenge does not seem to be feasible, especially given the fragile post-pandemic environment.

“While Ghana’s external buffers and moderate external debt amortisation schedule in the next few years afford the government a window of opportunity to deliver on its strategy, balance of payments pressures will build up the longer government’s large financing requirements have to rely on domestic sources,” it noted.

Apart from the long-term issuer and senior unsecured debt downgrade, Moody’s also downgraded Ghana’s bond enhanced by a partial guarantee from the International Development Association (IDA, Aaa stable) to B3 from B1, “reflecting a blended expected loss now consistent with a one-notch uplift on the issuer rating.”

It also lowered Ghana’s local currency (LC) and foreign currency (FC) country ceiling to respectively B1 and B2 from Ba3 and B1.

“Non-diversifiable risks are appropriately captured in an LC ceiling three notches above the sovereign rating, taking into account relatively predictable institutions and government actions, low domestic political, and geopolitical risk; balanced against a large government footprint in the economy and the financial system and current account deficits,” Moody’s said in its report.

About a month before the Moody’s rating, Fitch also downgraded Ghana’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘B-’ from ‘B’ with a negative outlook.

Source: Classfmonline.com

Trending Business

V/R: ECG and GRIDCo install 15 MVA transformer in Sogakope to boost power supply

09:03

DVLA warns public against licensing by private garages

08:19

Ing. Frank Kofi Apeagyei: The genius whose IFATSEA presidency can jet-propel Ghana’s aviation industry beyond the skies

05:36

Mahama rallies African leaders for one voice on debt ahead of 2025 G20 Summit

17:49

A/R: Gov't reaffirms commitment to Boankra Inland Port project – GSA CEO

17:41

Finance and Energy Ministers give life to construction of Ghana’s second gas processing plant

15:16

KGL Group Executive Chairman honoured at 2025 Millennium Excellence Awards

13:11

CDM demands apology from Mahama over failure to scrap COVID levy

09:12

Okudzeto Ablakwa leads first-ever home delivery of passports in Ghana

03:10

Parliamentary Select Committee on Trade visits Sunda Ghana, vows support for local industry

02:22