Cocobod sinks into ¢12.3bn debt leading to financial cost rise of ¢325m – A-G warns of 'industry crippling' risk

Cocobod CEO Joseph Boahen Aidoo

Cocobod CEO Joseph Boahen Aidoo

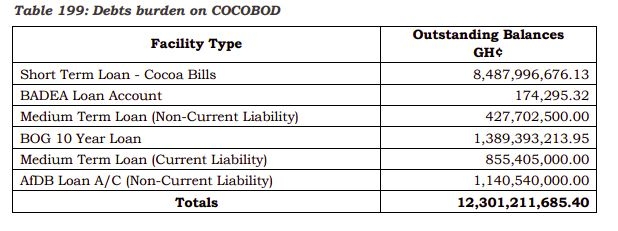

The Ghana Cocoa Board (Cocobod) is sinking into deep debt, the 2021 Auditor-General’s report has revealed, noting that the burden was as high as GH¢12.3 billion as of the 2019/2020 financial year.

Section 90 of the Public Financial Management Act, 2016 (Act 921) stipulates that the governing body of a public corporation or state-owned enterprise shall establish and maintain policies, procedures, risk management and internal control systems, and governance and management practices, to ensure that that public corporation or state-owned enterprise manages its resources prudently and operates efficiently in accordance with the objectives for which the public corporation or state-owned enterprise was established.

However, the Auditor-General said: “Our examination of the records of Cocobod noted that the Board has been burdened with relatively high loan portfolios over the years”, adding it has “debts totalling GH¢12,301,211,685.40 in its records as of the end of the 2019/2020 financial year”.

“We also noted from our review that the Board did not provide us any effective plans to reduce its debt burden into the future”.

Also, the report said the absence of sustainable debt plans coupled with the absence of effective long-term cost control measures, resulted in this state of affairs.

The debt burden resulted in increased financial costs over the years amounting to GH¢325,766,160.20.

“This, if not managed effectively, could lead to crippling of the cocoa industry”, the report warned.

The A-G said his office urged the “management to deploy and implement effective plans and strategies that would lead to the reduction of the Board’s debt burden within the medium to long term”.

It noted that the Cocobod “management has a detailed plan in place to reduce debt on the books of Cocobod. Cococbod is implementing tighter budgetary controls to ensure that debt is not accumulated but rather we make savings to repay all debts on our books”.

The report said Cocobod recorded a loss of GH¢426 million in the 2020 financial year, as compared with a loss of GH¢320 million registered in 2019.

This represents a 33% decrease in the Board’s financial performance over the period.

Revenue increased by 5.2% from GH¢9.76 billion in 2019 to GH¢10.27 billion in 2020.

Even though Cocobod recorded a 4.41% fall in cocoa production over the previous year, the rise in revenue was largely attributed to a higher export price per tonne of US$2,477 in 2020 compared with an average export price of US$2,236 for 2019.

Direct Cost increased marginally by 0.1% owing to an increase in the cost of Pest and Disease Control by GH¢480 million indicating a 4.421% increase.

Also, the report said distribution expenses and administrative expenses increased by 116.3% and 33.5%, respectively resulting in an operating profit of GH¢651 million, representing a 7.5% increase over the previous year.

Non-current assets increased marginally from GH¢8.21 billion in 2019 to GH¢8.24 billion in 2020, representing an increase of 0.4%.

The current assets went up by 44.3% from GH¢6.85 billion in 2019 to GH¢9.89 billion in 2020.

This was as a result of the Board holding much cash and cash equivalents at the end of the financial year and an increase in trade receivable.

The Board’s liquidity ratio (current ratio) improved from 0.75:1 2019 to 0.82:1 in 2020.

The increase notwithstanding, the Board would not be able to meet its short-term obligations as and when they fall due.

Read relevant excerpts of the report including Cocobod's responses to the A-G's findings:

Cocoa Bills

Management has obtained approval from the Board of Directors for the issuance of a Bond of up to US$3 billion to refinance the relatively expensive cocoa bills. The long-term debt which is relatively cheaper would be used to refinance the short-term debt that is expensive. According to the calendar in place, Cocobod will be issuing its maiden Eurobond by January 2022, and the proceeds will be used to refinance the cocoa bills on the books.

Badea Loan

The balance on the BADEA loan account of GH¢174,295.32 was a grant that was obtained by the Ministry of Finance on behalf COCOBOD some years ago. The amount was not meant to be repaid by COCOBOD because it was a grant. COCOBOD will contact the Ministry of Finance and obtain Parliamentary approval to be able to write-off the debt. Medium Term Loan (MTL) 1786. The total balance of non-current and the current liabilities on the Medium-Term Loan of GH¢1,283,107,500 has been settled. The balance of US$187,500,000 as at March 2021, was prepaid during the interest payment period of March 19, 2021. As a result of the prudent financial management being implemented, the MTL has fully been repaid 1-year ahead of schedule. Ten-year Bank of Ghana Loan

The balance on the 10-year BOG loan of GH¢1,389,393,213.95 is being serviced based on the repayment schedule agreed with the Bank of Ghana. Currently, the Central Bank has granted COCOBOD moratorium on the repayment of the principal amount until January 2022. The 10-year loan will be fully extinguished by November 2023.

AfDB Loan

The US$600 million 7-year AfDB/Credit Suisse loan with a moratorium of 2 years was contracted for the implementation of the Productivity Enhancement Programme (PEPs). So far, an amount of US$200 million (GH¢1,140,540,000.00) has been drawn down on the facility. The amount drawn down is securitised with 110% cocoa sales contracts which does not impact negatively on the current finances/cashflow of the Board. The repayment of the loan will commence in November 2021 with proceeds accruing from the maturing sales contracts in the custody of the Security Agent of the Facility. The purpose for which the loan was contracted has started showing positive results with the over one million (1,000,000) metric tonnes of cocoa production for the 2020/2021 crop year. The increased production will facilitate the repayment of the loan facility.”

Receivable from Government – GH¢2,251,364,855.22 1789.

Section 91 of the Public Financial Management Act, 2016 (Act 921) provides that, the Board of Directors of a public corporation shall ensure the efficient management of financial resources of the public corporation including the collection and receipt of moneys due to that public corporation. 1790. We noted from our review of financial transactions between COCOBOD and Government of Ghana (GoG) acting through Ministry of Finance (MoF) that, GoG as at 30 September 2020 owed the Board GH¢2,251,364,855.28 The details of the debt with their respective sources are shown table 201.

The inability of the Board to adjust producer price of cocoa in line with world market prices and delay of MoF in paying the debts accounted for this situation.

The anomaly contributes to increasing the debt burden on the Board, which poses a serious threat to the Cocoa industry.

We recommended to the Board to continue to engage MOF to ensure the settlement of the debt and ensure that Producer price of cocoa is in line with the world market price of the product.

Management responded that, “Following the receipt of GH¢1,739,468,190.77 from the Government, Management continues to engage with Ministry of Finance for the fully repayment of the receivable. COCOBOD has received an amount of GH¢993,811,926.37 in April 2021. In July 2021, COCOBOD received a further amount of GH¢476,482,910.44 from Government bringing the total receipt to GH¢3,209,763,027.58.

The decision to reduce the cocoa producer price in line with the prevailing international market price of cocoa has been communicated to the supervising Ministry for the attention of Government.”

Management provided evidence to corroborate swift transfer of GH¢1,460,294,836.81 by MoF to the Board as of July 2021 to bring the total receivable remaining from Government to GH¢791,070,018.47.

Unbudgeted expenditure – GH¢230.7Million

Section 22 (2) of the Ghana Cocoa Board (Amendment) Law, 1991 (PNDCL 265) requires, the expenditure of the Board to be in accordance with its estimates as approved by the Parliament.

Also, Regulation 78 (1d) of the Public Financial Management Regulations, 2019 (L.I. 2378) states that a principal spending officer of covered entity is personally responsible for ensuring in respect of each payment of that covered entity,’ ‘that there is a sufficient unspent amount of an appropriation for making the payment.

We noted during our review of the 2019/2020 approved budget statement that, COCOBOD expended an amount of GH¢230,700,424.38 on the principal repayment of a ten-year loan with Bank of Ghana (BOG) which was not included in the approved budget for 2019/2020 financial year.

Management did not provide estimate for the expenditure in the Budget statement. 1801. Management misapplied GH¢230,700,424.38 and thereby violated all the relevant sections of P.N.D.C.L. 265 and L.I. 2378.

We advised Management to ensure that all the Boards’ activities are adequately provided for in its estimates and ensure that it operates within approved budget.

Management responded that “COCOBOD Management wrote to the Central Bank to request for the deferment of the principal repayment on the facility. This was due to the difficulty encountered in securing sufficient cocoa sales contracts due to the effects of COVID-19 on the general business/commerce environment. In interim before the response was obtained, the Bank of Ghana demanded payment of the principal and therefore Management had to oblige in order to avoid a technical default on the loan. The deferral was subsequently granted. However, Management has made provision for the principal repayment in the 2020/2021 approved budget.”

Unrecovered Seed and Interest Fund – GH¢136,646,962.65

Section 4 of the Ghana Cocoa Board (Amendment) Law, 1991 (PNDCL 265) states, “any person or purchasing organisation authorised to purchase cocoa by the Board that has received any money from the Board to purchase cocoa for the Board and has not purchased the cocoa or has purchased part only of the cocoa, shall repay such money or the balance thereof as the case may be to the Board.”

Our review of the recovery of seed funds from Licence Buying Companies (LBCs) noted that Management could not recover seed funds and accrued interest totaling GH¢47,024,911.28 from LBCs for more than four cocoa seasons contrary to the provisions in the law.

Our Further review noted that two LBCs who were vibrant for the 2019/2020 crop season had outstanding obligations totaling GH¢89,622,051.37 to pay at the end of the financial year under review.

Source: ClassFMonline.com

Trending Business

NPA CEO says $200m needed to fully revamp TOR and expand capacity

12:35

TOR resumes crude oil refining after years of inactivity

10:32

Gov't to revive Juapong Textiles through PPP-Ablakwa reveals

10:12

TAGG raises alarm over GRA–TRUEDARE digital customs deal

14:15

Government, Afreximbank resolve issues over US$750m facility

10:17

Muntaka Entrepreneurship Hub trains over 100 women in Asawase

14:16

Ghana Gold Board rakes in over $10bn ahead of target

09:56

GEXIM faces GHS1.5bn credit exposure as NPLs near 30% — CEO

09:36

Six Degrees delivers immersive experiential production at Kweku Smoke’s revival concert

10:37

GIPC highlights govt’s commitment to retail sector transformation at GUTA conference

03:01